Steven DeSanctis who heads up Bank of America Merrill Lynch’s Equity Strategy/High Yield Strategy group makes the case for why M&A should pick up beyond the slightly better environment we saw in 2013.

He notes that the cost of borrowing is still historically low, that companies who’ve been the acquirer in a deal have seen gains in market value and, lastly, there’s still a ton of cash everywhere. These trends take a long time to play out and could act as a buffer beneath the market – it’s rare to see a bear market begin just as the M&A cycle first gets cooking.

Here’s BAML on corporate cash positions:

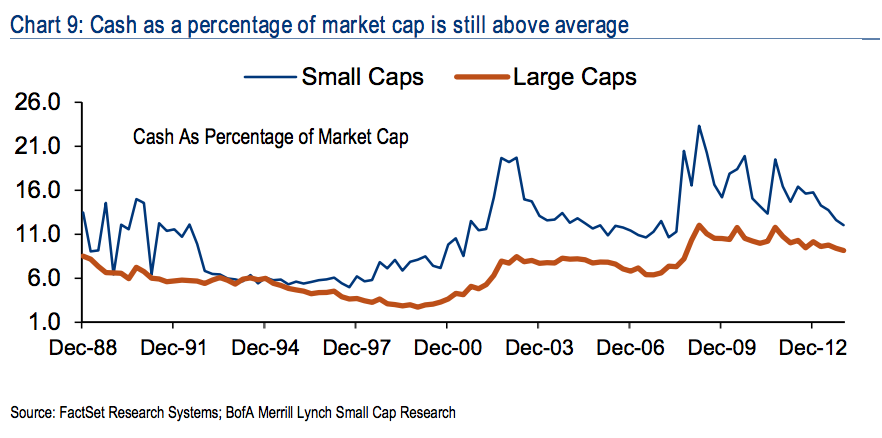

Overall valuations have been on the rise with much better equity performance but

we still see cash as a percentage of market cap above historical averages for

large and small caps (Chart 9). For the large cap Non-Financials, cash currently

represents about 10% of market cap, which remains well above the 30-year

average of 7%. As for small caps, 12% of the size segment’s market cap sits in

cash versus an average going back to 1988 of about 11%. The decline in these

ratios is attributable to a function of market caps rising and not an indication of

companies drawing down their cash levels.

Source:

M&A activity should pick up as markets make new highs

Bank of America Merrill Lynch – March 6th 2014

… [Trackback]

[…] There you can find 26876 additional Information on that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]

… [Trackback]

[…] There you will find 59643 additional Information to that Topic: thereformedbroker.com/2014/03/09/chart-o-the-day-still-corporate-cash-everywhere/ […]