Jerome P. Crabb said that “Crime is to man as fleas are to dog, the likelihood of its presence increases as the quality of one’s personal circumstances decreases.” You may or may not subscribe to the theory that people usually do bad things when they’re forced to and steal when their backs are against the wall. It’s a debate that’s been raging since Aristotle, we’re not going to solve it here.

Once upon a time, I was a stockbroker and spent a few months as a branch manager too (biggest mistake of my life, read the book). One of the things I can tell you for a fact was that the brokers who were in the worst shape financially were always the biggest compliance risks. This is very simple – in a transaction-oriented business where the worst practices and products will frequently offer brokers the highest pay, you’d have to be an idiot to expect a positive outcome for the client of a desperate salesperson.

If a broker had credit card people and repo guys and banks breathing down his neck, of course he’d be more liable to push a high-paying private placement on the wrong client, or churn a few accounts before the end of a pay period. This is human nature we’re talking about, in the brokerage business no less – not exactly an industry seen as the paragon of moral virtue to begin with.

This demented system of conflicted compensation arrangements is precisely why I hated it so much and couldn’t wait to escape it. It’s why I wrote Backstage Wall Street and so much of what you’ve read here on the blog.

The Wall Street Journal’s Jean Eaglesham and Rob Barry have confirmed this correlation between broke brokers and bad behavior in a new story this week. They looked at a rash of missing bankruptcy filings in brokers’ official records. They’ve cross-checked the disciplinary and complaint history for brokers who’ve filed for bankruptcy and found exactly what you would expect…

Mr. Leiva is one of more than 1,600 stockbrokers whose records failed to disclose bankruptcy filings, criminal charges or other red flags in violation of regulations, without regulators noticing, according to a Wall Street Journal analysis.

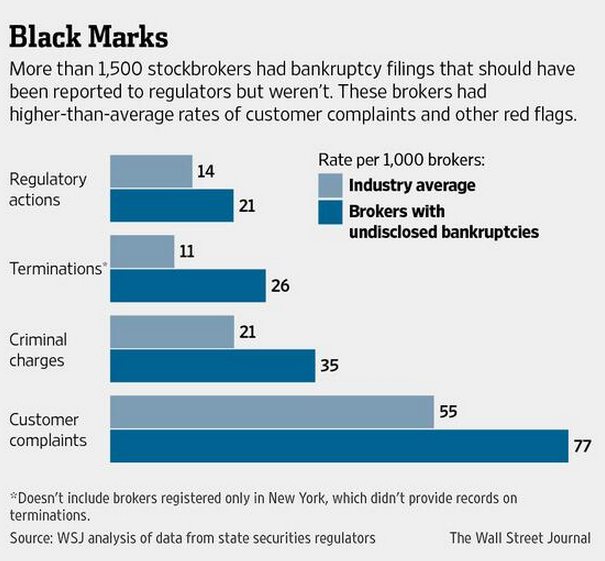

These same brokers have also accumulated more disciplinary actions by regulators and complaints from clients, on average, than other brokers, the Journal’s analysis of hundreds of thousands of stockbroker records shows…

While a bankruptcy filing in itself doesn’t suggest dishonesty, brokers who had unreported bankruptcies had worse disciplinary records than the industry norm, on average. For example, they were more than twice as likely to have been fired. About one in 33 had three or more other black marks such as customer complaints or terminations on their regulatory histories, a rate more than 65% higher than other brokers.

And a killer graphic:

The most toxic combination you could ask for is to put someone who owes a lot of money in a position to advise others. Throw in the perverse incentive of selling concessions on products and commissions on agency trades, and you have a disaster waiting to happen. Ain’t no amount of disclosure, fine print, oversight or potential consequences that are going to change that.

The Journal makes the case that people with bankruptcy filings have not done anything wrong, but if they’d disclosed these as they were supposed to, people might have thought twice before sending them investment capital to steward. And I agree.

Source:

Stockbrokers Fail to Disclose Red Flags (WSJ)

Read Also:

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/03/06/of-brokers-and-bankruptcy/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/03/06/of-brokers-and-bankruptcy/ […]