The 2013 Berkshire Hathaway annual letter to shareholders came out over the weekend and, as usual, it’s loaded with interesting insights from the chairman, Mr. Warren Buffett.

I have every Berkshire letter he’s written going back to 1965 (before he was even signing them for himself) collected in one PDF and it’s fun to watch the evolution of the company and the thought process of its leader evolve through time. This year, Buffett seems to be even more sentimental than usual about his own history. He’s also a bit more frank about the inevitability of his own death and how he sees the company adjusting in the aftermath – although next spring, on the 50th anniversary of Berkshire, we’ll hear a lot more about this topic from Warren and Charlie Munger in their own words, god willing.

Anyway, I’ve spent a chunk of the weekend going through this year’s missive and I’ve pulled out what I believe are the most important takeaways for a professional investor and young entrepreneur such as myself. I hope these are helpful and interesting for you. Direct quotes from the letter will appear in block italics…

1. Pride is not the same thing as arrogance

Warren Buffett loves Berkshire Hathaway like you’d love a family member. It’s his entire life and has been since he was a young man. He loves the companies that comprise the organization and the people who show up to run them each day. You can sense the pride – well-deserved – oozing from him as he praises various business units and their industry-leading strengths. Take for example, his two large regulated businesses, the railroads and the utilities:

Burlington Northern Santa Fe:

BNSF carries about 15% (measured by ton-miles) of all inter-city freight, whether it is transported by truck, rail, water, air, or pipeline. Indeed, we move more ton-miles of goods than anyone else, a fact establishing BNSF as the most important artery in our economy’s circulatory system. Its hold on the number-one position strengthened in 2013.

MidAmerican Energy:

MidAmerican’s utilities serve regulated retail customers in eleven states. No utility company stretches further. In addition, we are the leader in renewables: From a standing start nine years ago, MidAmerican now accounts for 7% of the country’s wind generation capacity, with more on the way. Our share in solar – most of which is still in construction – is even larger.

When Warren Buffett talks about his portfolio companies and their impact on America and the world, he is not bragging, he is gushing. And it’s entirely acceptable for him to do so – and well-earned.

2. Setting realistic expectations for one’s investors is important

Warren and Charlie are seeking to increase the value of the company for shareholders over the long-term – in excess of what could be received from just owning the Standard & Poor’s 500 Index. And they’ve certainly done it – earning a compounded annual gain of 19.7% a year for 49 years vs just 9.8% for the S&P, with dividends included. This equates to a return over the last half-century of some 693,518% vs the not-too-shabby 9,841% of the broad index. But they are realistic about their inability to keep pace with a raging bull market during any given period, the deficit owing to an unwillingness to be fully-invested in stocks or to pay high valuations for the leading companies.

Charlie Munger, Berkshire’s vice chairman and my partner, and I believe both Berkshire’s book value and intrinsic value will outperform the S&P in years when the market is down or moderately up. We expect to fall short, though, in years when the market is strong – as we did in 2013. We have underperformed in ten of our 49 years, with all but one of our shortfalls occurring when the S&P gain exceeded 15%.

Berkshire’s portfolio companies tend to be mature businesses and the company always keeps a huge cash position on hand ($20 billion plus) which can act as a drag when markets are melting up. Good stewardship of capital means having the courage to underperform when the environment calls for it. Buffett was happy to underperform during the tech bubble, sacrificing a short-term feeling of belonging for the long-term strategic advantage. Can his investors control their impulses as well?

3. It’s never too late to innovate

Buffett’s having fun with his new partnership-purchase of Heinz. The structure of the deal: Both Berkshire and a Brazilian private equity firm bought the company’s common stock, and then Berkshire, as the financing partner, bought a preferred stock paying 9% interest with the ability to exchange it for even more common shares later. Early results of the takeover have been encouraging and Buffett seems tickled by the creativity of the transaction. “With the Heinz purchase, moreover, we created a partnership template that may be used by Berkshire in future acquisitions of size.” Including Heinz, Berkshire now owns 8 1/2 companies that would be included in the Fortune 500 if they were standalone entities, we are told. One could envision Berkshire doing a Heinz-like transaction once a year!

4. Everyone screws up, even the world’s greatest investor

No one bats 1000 and Warren Buffett doesn’t either. Relaying the results of some of the smaller divisions within Berkshire – those “ranging from lollipops to jet airplanes” – Warren candidly explains that not every investment has panned out as hoped…

Some of these businesses…generate good returns in the area of 12% to 20%. A few, however, have very poor returns, a result of some serious mistakes I made in my job of capital allocation. I was not misled: I simply was wrong in my evaluation of the economic dynamics of the company or the industry in which it operated. Fortunately, my blunders usually involved relatively small acquisitions. Our large buys have generally worked out well and, in a few cases, more than well. I have not, however, made my last mistake in purchasing either businesses or stocks. Not everything works out as planned.

…and then there’s the $873 million loss from a commodity-related bond bet the chairman undertook before the oil and gas price crash:

Most of you have never heard of Energy Future Holdings. Consider yourselves lucky; I certainly wish I

hadn’t. The company was formed in 2007 to effect a giant leveraged buyout of electric utility assets in Texas. The equity owners put up $8 billion and borrowed a massive amount in addition. About $2 billion of the debt was purchased by Berkshire, pursuant to a decision I made without consulting with Charlie. That was a big mistake.

Buffett doesn’t dwell on these missteps, large and small. He takes a lesson away from them and moves on. Liquidity and diversification give him the ability to screw up without the consequences being fatal.

5. Insurance is the greatest business on earth

In 1967, Buffett bought two property and casualty insurance companies to offset the cyclical loss-making realities of the textiles business. The decision to do this would alter the course of his life and career, and he’s been waxing poetic about the insurance business every year since. The cash premiums paid by the firm’s insurance customers are Berkshire’s to invest where he’d like – this is called the float and it is an incredible source of capital. In 1970, Berkshire’s float from the insurance division gave them some $39 million to invest in stocks, bonds and elsewhere. In 2013, this float totaled a colossal $77 billion and change. Now that’s a war chest – no wonder Dan Loeb and David Einhorn have both launched reinsurance businesses of their own.

6. Numbers can’t always capture the true value of a business

Berkshire Hathaway is typically judged based on the change in the company’s book value, an accounting metric that, while important, fails to be indicative of anything about the future value of the business. Both Warren and Charlie feel very strongly that the value of Berkshire – both on the whole and in terms of its parts – is drastically undervalued based on what traditional book value captures.

Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life. The calculation of intrinsic value, though, is not so simple. As our definition suggests, intrinsic value is an estimate rather than a precise figure.

Buffett notes that two people – himself and Munger included – can look at the same facts on a balance sheet and income statement and then come up with two different calculations for what the intrinsic value of that business really is.

7. Delegate!

Warren is absolutely thrilled with Todd and Ted, his two protege hedge funders-turned-Berkshire PMs:

In a year in which most equity managers found it impossible to outperform the S&P 500, both Todd Combs and Ted Weschler handily did so. Each now runs a portfolio exceeding $7 billion. They’ve earned it.

I must again confess that their investments outperformed mine. (Charlie says I should add “by a lot.”) If such humiliating comparisons continue, I’ll have no choice but to cease talking about them.

Todd and Ted have also created significant value for you in several matters unrelated to their portfolio activities. Their contributions are just beginning: Both men have Berkshire blood in their veins

Buffett always makes it a point to give credit where it’s due, to highlight the successes of his managers where applicable and, most of all, to give talented people room to do their thing:

Charlie and I are the managing partners of Berkshire. But we subcontract all of the heavy lifting in this business to the managers of our subsidiaries. In fact, we delegate almost to the point of abdication: Though Berkshire has about 330,000 employees, only 25 of these are at headquarters.

Charlie and I mainly attend to capital allocation and the care and feeding of our key managers.

8. Invest like an owner, acknowledge your weaknesses

Buffett loves his common stock positions and he’s accumulated large percentages in some of America’s most enduring businesses like Wells Fargo, Coke, IBM and American Express, even though he does not control them as he does his wholly-owned subsidiaries. And he’s fine with that:

At Berkshire, we much prefer owning a non-controlling but substantial portion of a wonderful company to owning 100% of a so-so business; it’s better to have a partial interest in the Hope diamond than to own all of a rhinestone.

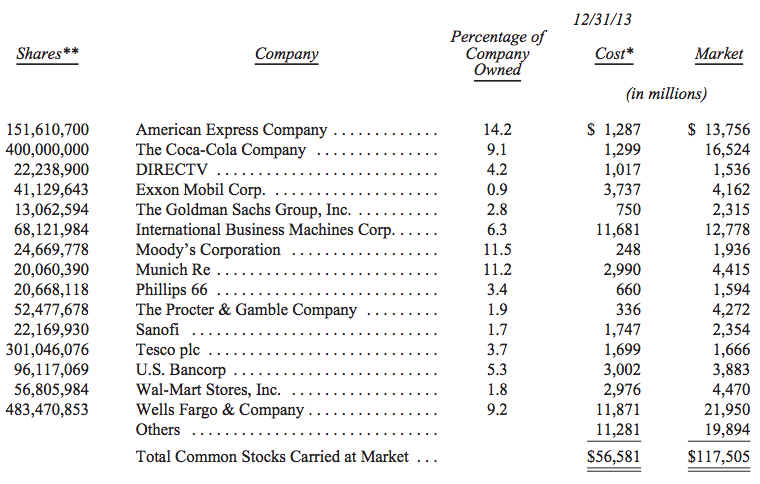

These are Berkshire Hathaway’s fifteen largest stock positions, along with their dollar cost-basis:

He also doesn’t trade into or out of them based on macro-forecasting or the market-timing opinions of others. He hopes they come down in price so he can own more of them while many other investors are hoping their stocks go up so they can sell out of them. Without naming names, he intimates that Wall Street is the enemy and that investors ought to treat their stock portfolios more like real estate, despite the greater liquidity of the former.

Both individuals and institutions will constantly be urged to be active by those who profit from giving advice or effecting transactions. The resulting frictional costs can be huge and, for investors in aggregate, devoid of benefit. So ignore the chatter, keep your costs minimal, and invest in stocks as you would in a farm…

The best piece of advice Warren Buffett imparts during this year’s letter also makes for a fitting close to this post, so I’ll let him take us out of here:

the “know-nothing” investor who both diversifies and keeps his costs minimal is virtually certain to get satisfactory results. Indeed, the unsophisticated investor who is realistic about his shortcomings is likely to obtain better long-term results than the knowledgable professional who is blind to even a single weakness.

***

Thanks for everything you’ve taught us this year, Mr. Buffett.

Source:

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] There you can find 22888 additional Info to that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] There you will find 90428 more Information on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Here you can find 8100 more Info on that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2014/03/02/8-things-i-learned-from-warren-buffett-this-weekend/ […]