361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

September, 23 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

@upsidetrader: Ahh Belize, it won’t be long now

@ReformedBroker: The Fed only told us 17,000 times they would be data dependent. The data hasn’t been good so they held back. Wow, mind-blowing.

The Fed surprised 2/3rds of Economists last week and didn’t TAPER…

Clearly, the numbers didn’t meet the Fed’s preconditions for tapering. And while the jobless rate has fallen to 7.3% (from 8.1% when QE3, the current round of quantitative easing began), Bernanke had to acknowledge what’s been obvious to all. The decline in the jobless rate hasn’t occurred just because more folks are getting jobs; it’s because many are dropping out of the workforce, which means they’re not counted as unemployed by the government. Weighing the data against their dicta, Bernanke & Co. decided against being painted into a policy corner, even though the markets had inferred their rhetoric meant a reduction of at least $10 billion in the monthly bond buys. After all, how would they be able to justify reducing accommodation while growth was slowing (gross domestic product in the current quarter is likely to grow at less than a 2% annual rate, down from the none-too-exciting 2.5% pace in the second quarter) and official inflation measures (for whatever they’re worth) are running below the Fed’s 2% target?

(Barron’s)

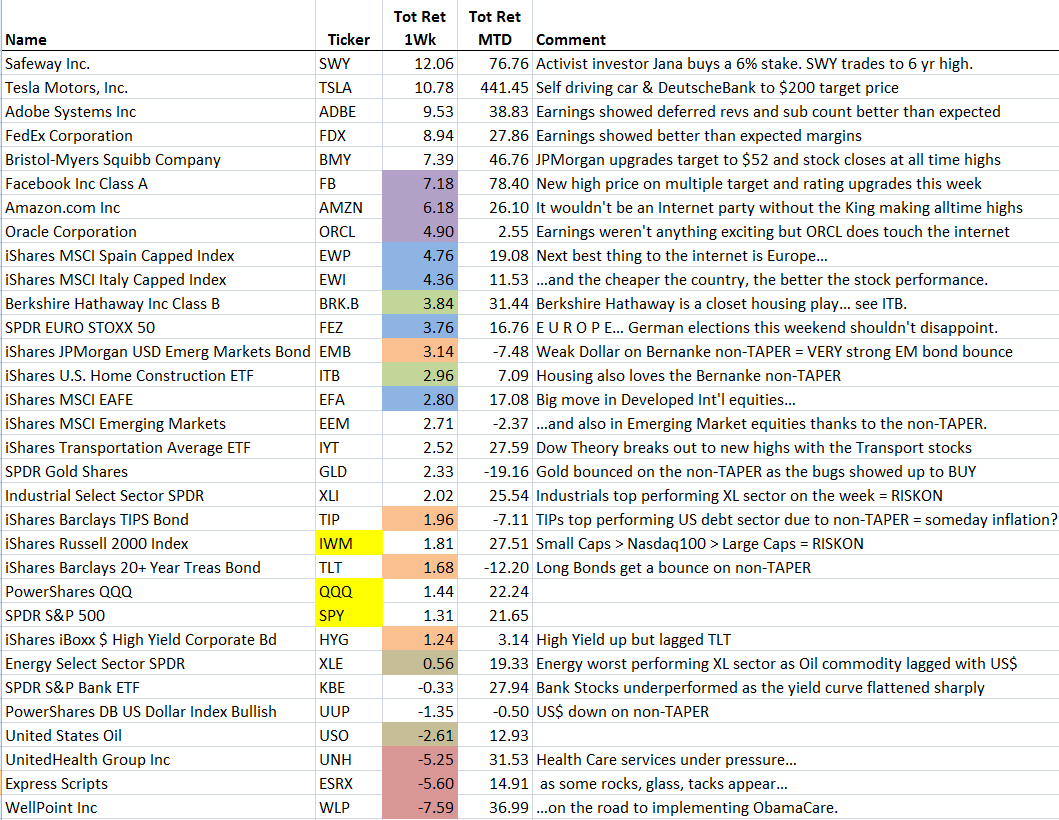

With the non-Taper, every financial market surged higher: Equities, Bonds, Commodities, and Foreign Currencies. If you are confused about how to position your portfolio, Jared Dillian, had a comedic pen full of ideas…

“The only rational thing to do here is buy everything that isn’t nailed down. Buy oil. Buy gold. Buy wheat, corn, and beans. Buy copper, lead, and tin. Buy the whole damn commodity index. Buy it until your head caves in. Buy EUR, CAD, AUD, and NZD, and finance it by selling the bolivar, er, I mean the dollar. Buy GE, MSFT, PFE, XOM, and CSCO. Buy the SPX. Buy the NDX. Buy the S15HOME. Sell puts on homebuilders and use the proceeds to buy a house. Buy POT. Buy AGU. Buy several 50-pound bags of fertilizer and keep them in your basement. Buy 100 propane bottles at Home Depot. Buy Home Depot, home equity loans are back in style. Buy a ballpeen hammer. Buy an air compressor. Buy a cheese grater. Buy a German Shepherd. Buy a racehorse named “Currency Debasement.” Buy one of those things you shake up and it snows inside. Buy one of those things you push and make the lines on a baseball field. Buy a baseball team. Buy the Washington Nationals and rename them the “Dirtnaps.”

(DailyDirtnap)

As we head into the end of 2013, there are a few questions (Will Yellen be running the next Fed meeting? When will Congress make a deal on the debt limit? What will happen to Walter White?), but it looks as if the Fed has given Portfolio Managers a green light. Jeff deGraaf’s thoughts into the final stretch…

Our biggest concern for the remainder of the year is melt-up risk. The Fed has forced shorts to cover, the global economy is increasing risk appetites, and a vast majority of managed money is underperforming their respective benchmarks for the year. That makes the remainder of the year a prime candidate for performance chasing.

(RenMac)

Investors have also taken the green light by adding to their equity holdings in size…

Investors in funds based in the United States poured $18.1 billion into stock funds in the latest week as global markets rallied on expectations the Federal Reserve would maintain its easy-money policies, data from Thomson Reuters’ Lipper service showed on Thursday. The inflows into stock funds over the week ended September 18 were the biggest since early January. Investors have committed nearly $31 billion to stock funds in the latest two weeks, marking the strongest two-week run for the funds since Lipper began tracking them in 1992.

(Reuters)

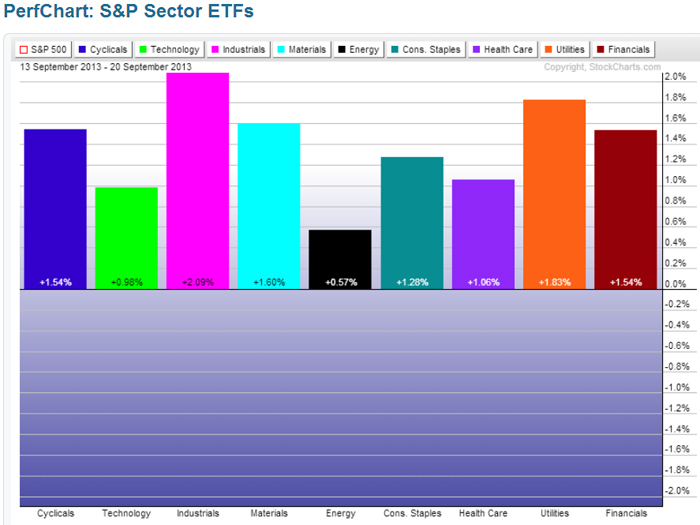

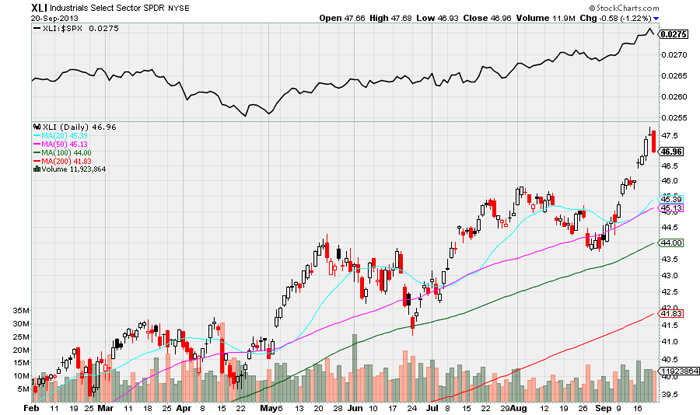

The Fed’s non-TAPER was positive for all sectors of the U.S. market with the RISKON Industrial sector leading the way…

Foreign markets also loved the Fed’s non-TAPER and ripped higher…

Bond Yields are trying to work lower from their significant move higher…

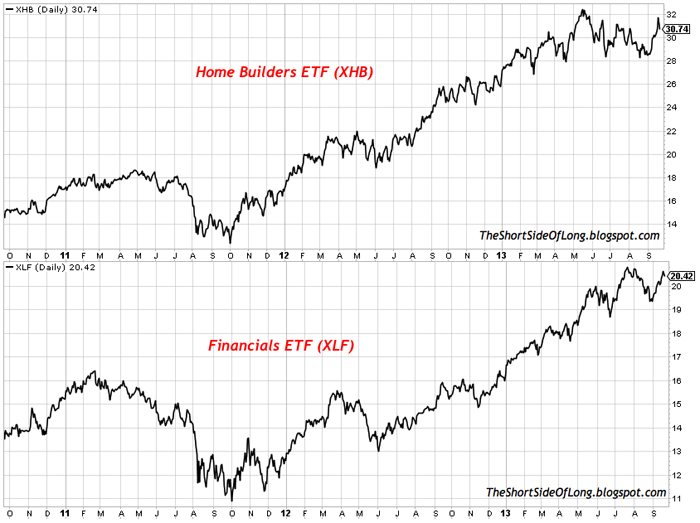

What if yields do correct lower into year end and housing sparks higher? Could Berkshire Hathaway, and the housing indexes (ITB and XHB) move back to 2013 highs?

Looking again at Industrials, they continue to be the sector to be overweight…

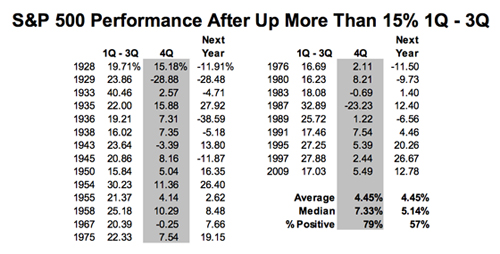

Lazlo Birinyi points out that strength begets further strength going into the 4th quarter of the year…

Interesting to see that it also tends to set up an equally good following year.

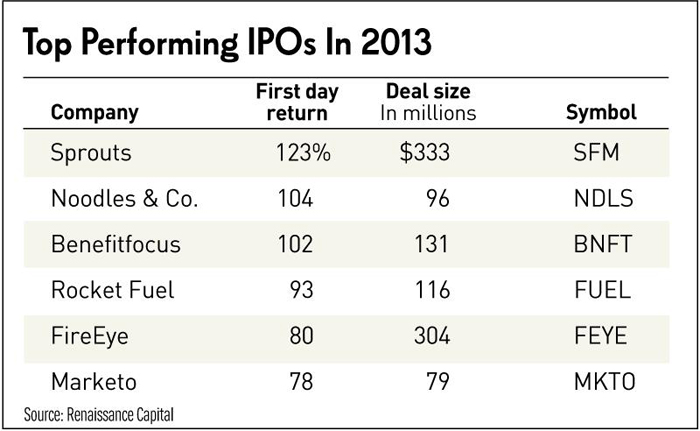

A further confirming sign of the strength in the risk appetite of the markets would be the performance of recent IPOs. And last week, we had 2 IPOs that jumped 100%+ on their 1st day of performance…

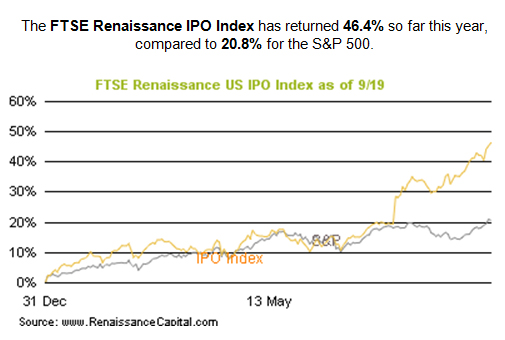

Looking more broadly at the performance of IPOs shows equal strength…

Behind all the strength, we still need to keep an eye on the Financial stocks…

Banks were hurt last week by the flattening yield curve post the non-TAPER and talk of weak fixed income trading activities. We would like to see an increase in loan growth and net interest margins at the banks which could help the group reclaim their highs. As for home builders, it will come down to a pullback in interest rates and increase in foot traffic of new home buyers.

Meb Faber – Keeping it simple for you…

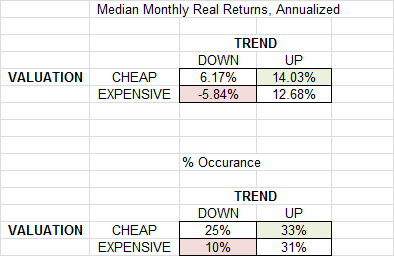

US stocks since 1900 across trend and valuation. Trend is > 10 month simple moving average. Valuation is CAPE <> 17. Not rocket science. Not surprisingly, the best time to be invested is in a cheap, uptrending market. The worst time? An expensive, downtrending market. (The returns are median monthly returns after inflation, annualized.) We are currently in the category of up, expensive. The biggest shock occurs when the expensive US market moves into a downtrend.

(MebaneFaberResearch)

So if you want to gather assets from Goldman Sachs, it would be a good idea to EBay your golf clubs…

Kent Clark, CIO for hedge fund strategies, alternative investment, and manager selection at GSAM, told an audience at the company’s annual London investor conference that his team has a novel way to check whether a manager has his eye on the right ball. Clark’s team watches the golfing round-recording site run by the PGA to watch out for managers updating their handicaps, which can indicate they’ve been spending too much time on the fairway, and not enough time by their Bloomberg.

(aiCIO)

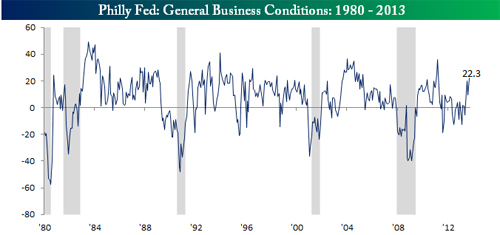

Looking at the economy last week, one of the more watched data streams, the Philly Fed, surprised to the upside…

This morning’s release of the Philly Fed Index came in at a level of 22.3, which was significantly ahead of the consensus forecast of 10.3. This morning’s release was also the highest level since March 2011. Today’s release was not only strong on the headline reading, but it was also strong in its internal readings. As shown in the table, all nine of the index’s components also showed increases compared to last month’s levels. Even more encouraging was the fact that the biggest gains came in Shipments (+22.1) and New Orders (+15.9).

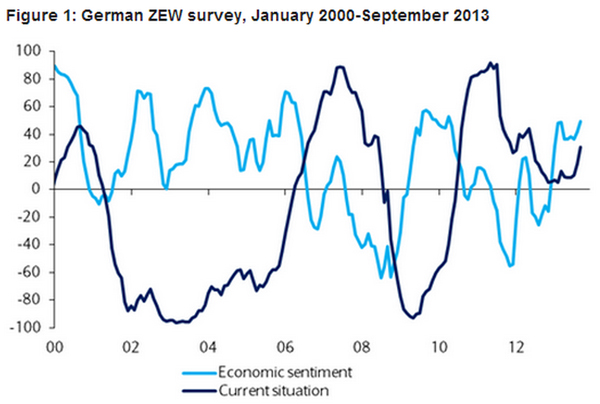

And across the pond, the German ZEW continues to bend higher…

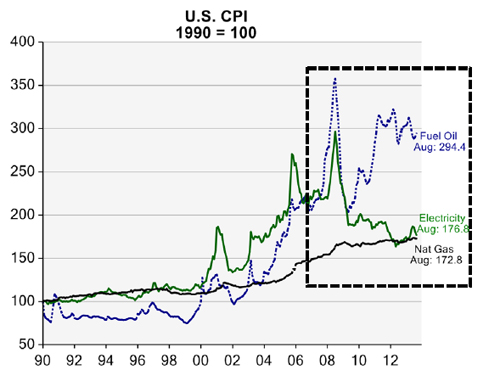

A significant chart showing the importance of cheap natural gas on all of our electric utility bills…

Prior to the explosion in fracking, electricity prices have been more correlated to fuel oil and coal pricing. But as utilities shift toward more natural gas, electricity pricing has fallen to the lower fuel cost. Not only great news for American consumers, but also an amped heartbeat for the growth in U.S. manufacturing.

(CornerstoneMacro)

A good week for FIVE… Global consumers just spent $4+ billion buying the new iPhone5 and Grand Theft Auto V…

Apple Inc. (AAPL) is poised to announce record opening-weekend sales as throngs of excited customers waited through long lines in Sydney, Tokyo, London, and San Francisco to pick up the latest iPhones. Sales for the iPhone 5s and 5c started yesterday with crowds in Sydney and extended through stores in the U.S., Canada, China, France, Germany, Hong Kong, Japan, Puerto Rico, Singapore, and the U.K. In London, the line at the Regent Street Apple store stretched for a mile. The demand has analysts predicting Apple will sell 6 million to 7.75 million iPhones over the weekend, topping last year’s debut-weekend record of 5 million. The projections, along with limited supplies of gold iPhone 5s models, shows pent-up demand for Apple gadgets and also underscores how the Cupertino, California-based company has maintained customer loyalty — even as sales and profit growth slowed and shares fell amid competition with Samsung Electronics Co. (005930) and others.

(Bloomberg)

Sidenote for the 50% of you who haven’t upgraded to iOS7…

If you a looking for an exhaustive review, this is a good one:

(pxINV)

@ericgarland: Culture: The jazz segment of the record industry sells around $100 million a year. Grand Theft Auto V sold $800 million in 24 hours.

“Grand Theft Auto V” took three days to pass more than $1 billion in world-wide retails sales, faster than any other form of entertainment, the videogame’s publisher said.

(WSJ)

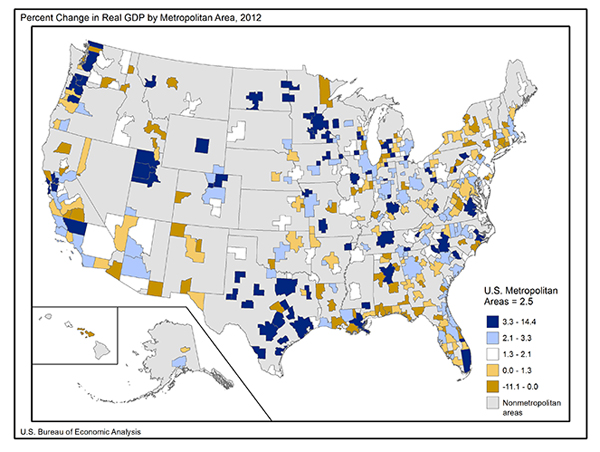

If you own a Small Business or Real Estate in a Dark Blue region, you are two steps ahead in the wealth creation game…

And if you are looking for a better opportunity, GET TO THE BLUE REGIONS!

Here are the fastest growing metropolitan cities in terms of 2012 GDP growth. Texas and Indiana are getting it done:

Midland, TX (14.4%)

Odessa, TX (14.1%)

Elkhart-Goshen, IN (11.4%)

St. Joseph, MO (9.8%)

Columbus, IN (9.6%)

Victoria, TX (8.7%)

Bismarck, ND (8.5%)

Kokomo, IN (8.4%)

New Orleans, LA (7.6%)

San Francisco, CA (7.4%)

(BusinessInsider)

(BEA)

An interesting read on Youth Travel Sports that will no doubt spur much conversation…

What are you teaching your child when you spend thousands of dollars on youth sports? Some people may argue that you are showing your child how much you love them. But when has it ever made sense to measure love with money? Think of the sacrifices that parents willingly make in the name of youth sports. I’ve personally seen people take on extra shifts, or even an extra job, in order to pay the expenses associated with youth sports. While it certainly is none of my business how someone chooses to spend their money, I would like to offer up a strange financial/psychological side-effect that can appear in the children of those people that spend thousands of dollars on youth sports: a lack of financial perspective.

A commitment to travel sports, in spite of finite financial and time resources, isn’t simply a way to display your love and support of your child. I think it can actually suggest the unwillingness to say no to your child in the midst of a tremendous number of facts and math. Is it possible you are teaching your child a terrible lesson when you are saying yes to a situation that calls for no? Because if you are prioritizing youth sports over college, or youth sports over debt-free living, you are being irresponsible. Your children can either sense the obvious absurdity of your irresponsibility and vow to never repeat it, or they might just adopt your flawed way of thinking.

(PeteThePlanner)

Always a good reminder…

@EdMatts: “Choose a job you love, and you will never have to work a day in your life.” Confucius

Finally, a life in full cut way, way too short…

If you were an investor in growth stocks in the 1990’s, you knew Joy Covey. At Janus, growth stocks were our priority so we spent much time with Joy working on Amazon. She educated many investors not only about Amazon’s long term goals, but also about the broader evolution of the Internet, as well as its impact on Retail and other industries. Here are a few good stories on Joy and her full, but shortened life:

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

… [Trackback]

[…] There you can find 47090 additional Information on that Topic: thereformedbroker.com/2013/09/24/361-capital-weekly-research-briefing-57/ […]

buy cialis tadalafil uk

SPA

cialis without presciption in usa

American health