361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

August 12, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

The dog days of summer are upon us…

Hopefully you are reading this from the beach, because there is so little news happening in the markets that those of us in the office are about to start making news up to justify stock price movements. But while news and volumes are at August lows, here are some thoughts that might ring a bell to help you to either make some money or to set down your smartphone and get back to the water.

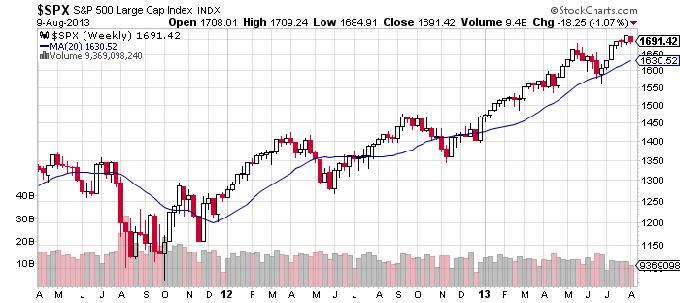

As this weekly chart of the S&P500 shows, the major trend is still up and to the right…

The trend for the summer has been less interesting with only a +0.25% net gain, but a decent range for those who traded the end of June dip…

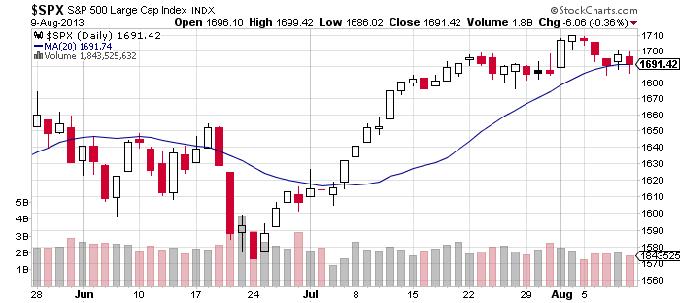

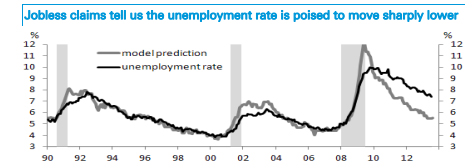

If you are tired of Taper talk and Fed Chair odds making, the markets did receive continued good news out of Jobless Claims last week…

But of the data we’ve had this week; it’s the weekly jobless claims that could prove most telling. Although the number of fresh claims rose last week from the week before, the four-week moving average for claims dropped to its lowest level since just before America slumped into recession in December 2007. Using jobless claims data, economists at Deutsche Bank have created a model which they say shows, given the level of weekly jobless claims, the unemployment rate has much further to fall (see chart below). Indeed, they argue the expectation of quicker U.S. economic growth in the second half of the year should see the unemployment rate fall more quickly than it did in the first, when it dropped from 7.9 percent to 7.4 percent.

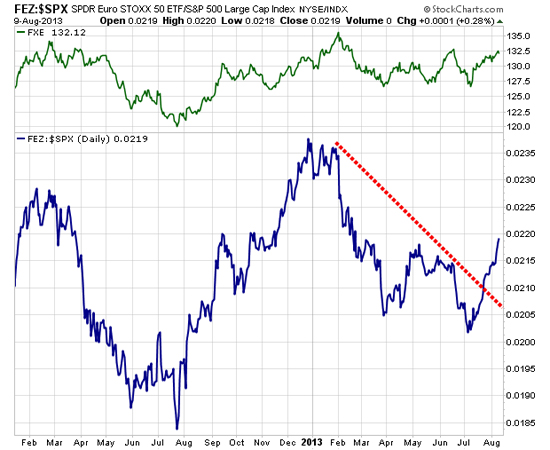

And European equities continued to trade off of their improving economic data points and sentiment…

Europe even now breaking higher versus U.S. equities…

Bloomberg making the case for owning Europe…

European stocks have risen half as much as global benchmarks this year, leaving them cheaper than equities in the U.S. and Asia as the region’s economy starts to recover from the longest recession on record. After a 7.2 percent gain in 2013, the Euro Stoxx 50 Index (SX5E) trades at 12.5 times projected earnings, 6.7 percent less than in 2009, the last time the euro area was in the final quarter of a contraction, data compiled by Bloomberg show. In the U.S., where the economy is in its 10th straight quarter of growth, the Standard & Poor’s 500 Index is valued at 15.3 times estimated profit and Japan’s Topix trades at 14.2 times income after Prime Minister Shinzo Abe vowed to end two decades of deflation.

Investors from JPMorgan Chase & Co. to Barclays Plc say European stocks are cheap as the first expansion for euro-area manufacturing in two years helps drive forecasts for profit growth of more than 10 percent in 2013 and 2014. Bears point to concern that next month’s German election may lead to a push for tougher austerity measures in Europe’s weakest economies. “Compared with the last time the euro zone was improving, stocks look relatively cheaper,” Kerry Craig, a London-based market strategist at JPMorgan Asset Management, said by telephone. His firm oversees $1.5 trillion globally. “If you have a continued period of things not getting worse and data getting better, that will build confidence in markets and people will move into equities.”

(Bloomberg)

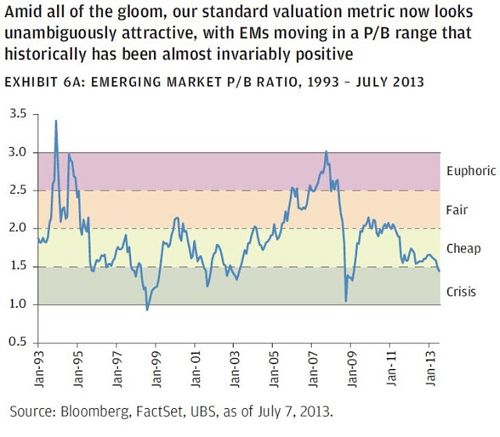

Meanwhile, UBS is making the Long Term case to BUY Emerging Markets…

And Emerging Markets versus U.S. equities is trying to make a bottom this summer…

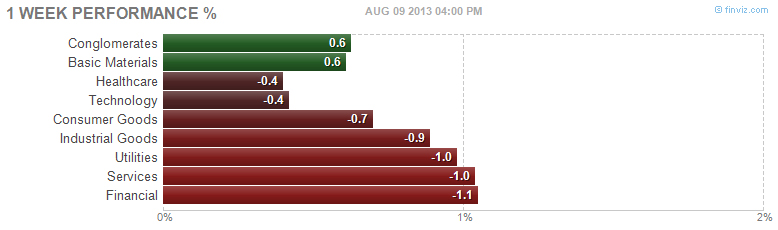

Financials have started to take a breather here after their post earnings run. Keep an eye out here as Financials have helped lead the market in 2013.

And because of the move in interest rates, Housing stocks are doing all they can from breaking to 2013 lows…

Meanwhile a new group emerged to set new 2013 highs this week. The Materials group has China to thank as recent economic data has come in better than expected and as a result, China is buying copper and other industrial metals again…

Most sectors down in light trading last week…

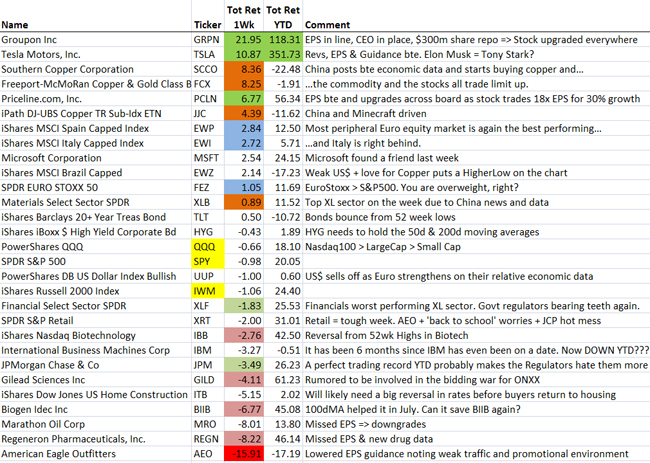

Earnings still causing the biggest ripples in stock prices…

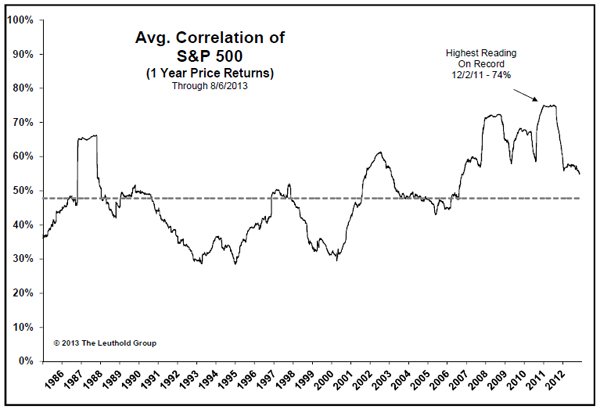

Good news for stock pickers as equity correlations continue to decline…

While still elevated relative to historical readings, longer-term correlations are now at their lowest levels since October 2007. This is primarily due to the lack of major risk-off episodes over the last year and a half. This development should be great news for active managers everywhere. In times of high stock level correlations, it’s hard for a manager to add value with stock selection. The current lower levels allow managers to exploit more stock-specific risk. Lower levels from here would be even better news.

(Leuthold Group)

While correlations have trended lower, iShares sees an uptick in equity volatility come September…

While I still believe U.S. and global equity valuations are reasonable and stocks can advance over the next year, market volatility is likely to increase in September for four reasons:

- September is the one month of the year when the calendar really does matter. Looking at data on the Dow Jones Industrial Average back to 1896, September has historically been the worst month of the year for stocks, with a consistent, and statistically significant, negative bias. This September swoon phenomenon extends beyond the United States. September has also historically been the worst month of the year in a number of European markets – including Germany and the United Kingdom – and in Japan.

- Anxiety over Fed tapering is likely to climb as we approach the Fed’s September meeting.

- Europe is likely to re-emerge as a source of volatility as Germany holds an important federal election in September.

- The U.S. budget debate will heat up again as Congress needs to pass a continuing budget resolution before the fiscal year ends on September 30th. Not surprisingly, Congress has made little progress to-date.

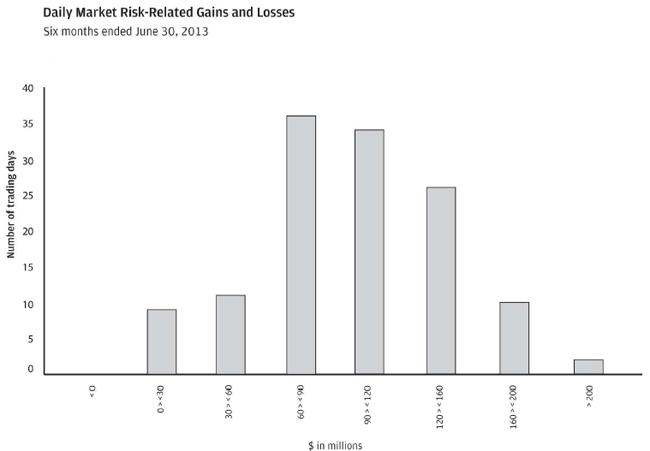

A glance at recent filings show that the JPMorgan Trading Desk is batting 1.000…

The firm posted market risk-related gains on each of the 128 days in this period with two days exceeding $200 million; there were no loss days in the six months ended June 30, 2013.

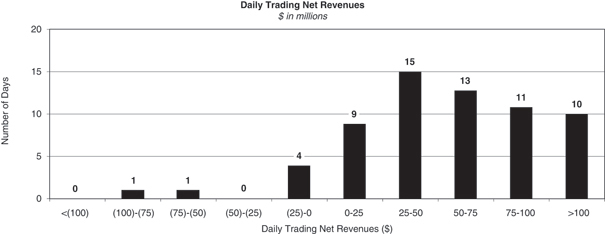

…while Goldman Sachs batted 0.953…

With bond managers not doing as well as their brokers, their customers continue to bolt…

Investors pulled a record $3.27 billion out of U.S.-based funds that hold Treasuries in the latest week as uncertainty grew over when the Federal Reserve may wind down its stimulus, data from Thomson Reuters’ Lipper service showed on Thursday. The outflow from Treasury funds in the week ended Aug. 7 was the biggest since Lipper records began in 1992.

(Reuters)

Norway also finds less of a reason to invest in fixed income…

Norway’s oil-fueled sovereign wealth fund, the world’s largest, said on Friday that it’s continuing to move money out of bonds and into equities, reflecting a broader global souring on fixed income markets. “I have said before it is less a reflection of enthusiasm for the equity markets and more a lack of enthusiasm for the bond markets,” fund CEO Yngve Slyngstad said, according to reports. The fund said it lowered its bond holdings to 35.7 percent, down from 36.7% a year ago. The fund’s stock holding increased to 63.4 percent from 62.4 percent.

(IBT)

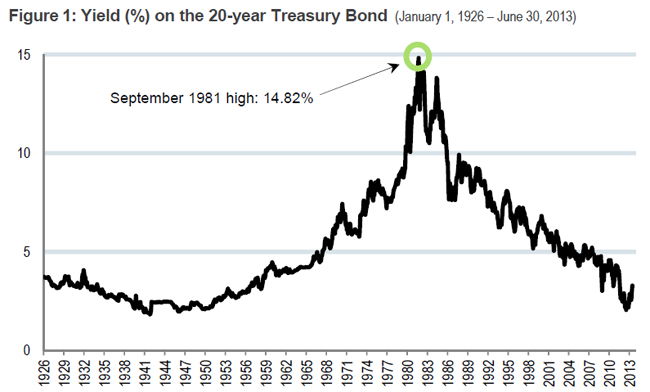

Jim O’Shaughnessy is following Norway’s move even further…

Yet, if you look at Figure 1, you’ll see that for middle-aged investors, the yield on the 20-year Treasury has been in near freefall for the last 32 years. In September 1981 it hit a high of 14.82 percent and has pretty much declined steadily from there. To put this in perspective, I was 21 years old in 1981, so, for all of my adult life I have lived in a world of declining interest rates. It’s these very long-term trends that tend to become ingrained in our brain and determine how we think about certain investments. Even so, we believe that this is a generational selling opportunity for investors in the 20-year Treasury and other long duration bonds. Let’s see why…

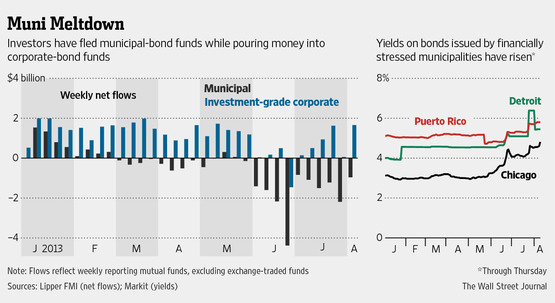

Meanwhile, money continues to move out of Municipal Bonds on the Detroit event…

And the Detroit news is raising the cost of other Michigan municipalities to finance their debts…

Two weeks after Detroit declared bankruptcy, cities, counties and other local governments in Michigan are getting a cold shoulder in the municipal bond market. The judgment has been swift and brutal. Borrowing costs are up around the state, in some cases drastically. On Thursday, Saginaw County became the latest casualty when it said it was delaying a $60 million bond sale planned for Friday. It had hoped to put the proceeds into its pension fund. It was the third postponed bond sale in Michigan since Detroit dropped its bombshell on July 18. Earlier this week, the city of Battle Creek said it would postpone a $16 million deal scheduled for August because of concerns that investors would demand interest rates that were too high. And the previous week, Genesee County withdrew a $54 million bond sale from the market for the same reason.

(NYTimes)

When does Chicago become Detroit?

The pension fund for retired Chicago teachers stands at risk of collapse. The city’s four funds for other retired city workers are short by $19.5 billion. At least one of the funds is in peril of running out of money in less than a decade. And starting in 2015, the city will be required by the state to make far larger contributions to the funds, which could leave it hundreds of millions of dollars in the red — as much as it would cost to pay 4,300 police officers to patrol the streets for a year. “This is kind of the dark cloud that’s coming ever closer,” Mr. Emanuel said in a recent interview, adding that he had no intention of raising his city’s property taxes by as much as 150 percent — the price tag, he says, that it might take to pay such bills. “That’s unacceptable.”

(NYTimes)

And when does New York City become Chicago?

“Short-sightedness. Corruption. Mismanagement. And—perhaps most dangerous of all—special interest politics,” the mayor declared, could break the city’s “virtuous circle” of good governance. “We are only a short distance from relapsing into decline if we allow health-care and pension benefits to crowd out the investments that make New York City a place where people want to live, work, study and visit.” According to the mayor, the city is spending $8 billion on pensions—more than five times as much as when he took office. Whose fault is that? Well, the mayor doesn’t say, but the expired collective-bargaining agreements that most employees are still working under require non-public safety workers to contribute a mere 3% of their salaries to their pensions. Meanwhile, 95% of workers and retirees don’t have to pay a penny for their health benefits.

(WSJ)

Kid Rock becoming Disruptive in the Music Industry…

When Kid Rock unveiled his $20 ticket innovation in the spring, he didn’t mince words: He was out to rock the concert industry. Ticket prices had gotten out of hand, the Detroit star said. Fans were disgruntled. Pitting himself against the “highway robbery” of $200-plus tickets for acts such as Jay Z and Justin Bieber, Rock declared himself a music-biz revolutionary: For his 40-date summer tour, seats in every section would be $20. Beers would be $4. Tickets purchased at Wal-Mart would have no extra fees. As Rock hits DTE Energy Music Theatre Friday night to begin an eight-show stand — a record run boosted by the cheap tickets — it’s clear his summer adventure has the close attention of an industry looking for lessons… Rock’s camp, meantime, is already proclaiming it a grand slam. In most markets, his show attendance is up substantially from 2011, in some cases threefold, said Rock’s manager, Lee Trink. The remaining six weeks of shows, with opener ZZ Top, are nearly sold out. The week after the DTE stand wraps up on Aug. 20, Rock expects to play to 28,000 in Chicago, where he drew 15,000 two summers ago.

(DetroitFreePress)

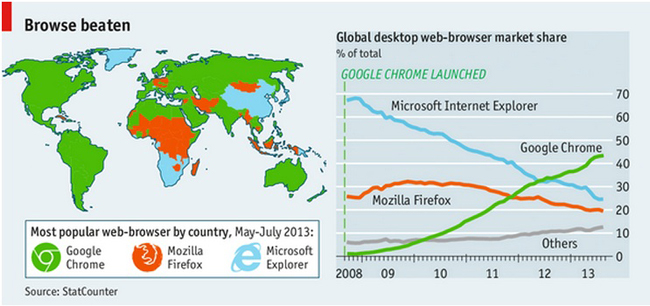

Google is the Disrupter in Web Browsing…

(The Economist)

Colorado has no interest in Creative Destruction and would rather ban Innovation. How soon until I can stand in a bank teller line again? Could we also go back to only land lines and live horse powered transportation to solidify our position as a cow town/state?

Colorado regulators, after a year of meetings, filings and public hearings, moved a step closer this month to outlawing the black-car e-hailing service offered by Uber Technologies. At least a half-dozen jurisdictions across the country are wrangling with the same challenge of determining how Uber’s disruptive service fits into decades-old transportation rules. Colorado’s answer, as proposed by an administrative law judge, is that it will not regulate Uber. The judge has instead recommended, among other things, a new rule that will bar the startup’s limousine partners from using devices such as iPhones to calculate fares based on time elapsed and distance traveled after picking up a customer, a key component of Uber’s on-demand business. If adopted by the Colorado Public Utilities Commission, the state would become the first to pass rules that make it illegal for Uber to operate, driving away a much-beloved Silicon Valley star.

(DenverPost)

If you are looking for some investment reading for your Kindle, the old Berkshire Hathaway letters are always a good read…

@derekhernquist: AWESOME Deal. Berkshire Hathaway Letters to Shareholders 1965 – 2012 on kindle is only $2.99 No brainer investment.

(Amazon)

And something to strongly consider for extending your life = a standing desk. It doesn’t matter if you run a marathon each weekend. If you sit at your desk all day, you are taking time off of your life. If you spend your days on the phone, do laps around your office. If you are tethered to a mouse, get a standing desk. Just get rid of your chair and get UP…

WINSTON CHURCHILL knew it. Ernest Hemingway knew it. Leonardo da Vinci knew it. Every trendy office from Silicon Valley to Scandinavia now knows it too: there is virtue in working standing up. And not merely standing. The trendiest offices of all have treadmill desks, which encourage people to walk while working. It sounds like a fad. But it does have a basis in science. Sloth is rampant in the rich world. A typical car-driving, television-watching cubicle slave would have to walk an extra 19km a day to match the physical-activity levels of the few remaining people who still live as hunter-gatherers. Though all organisms tend to conserve energy when possible, evidence is building up that doing it to the extent most Westerners do is bad for you—so bad that it can kill you. That, by itself, may not surprise. Health ministries have been nagging people for decades to do more exercise. What is surprising is that prolonged periods of inactivity are bad regardless of how much time you also spend on officially approved high-impact stuff like jogging or pounding treadmills in the gym. What you need instead, the latest research suggests, is constant low-level activity. This can be so low-level that you might not think of it as activity at all. Even just standing up counts, for it invokes muscles that sitting does not.

(TheEconomist)

Tweet of the Week…

@emptywheel: Help me out here. Does the same guy who owns WaPo also own CIA’s cloud storage?

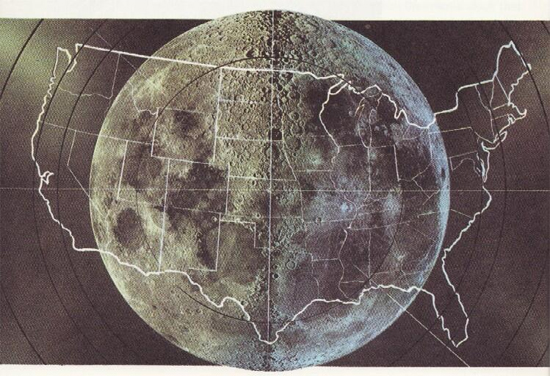

And while you are lying on your back, gazing at the stars this summer, here is one to quiz your kids on…

@Cmdr_Hadfield: Good morning! Perspective – how big is our Moon?

Now back to the beach with you!

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Here you can find 13807 more Info on that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/08/13/361-capital-weekly-research-briefing-52/ […]