Don’t underestimate the Fed’s mouth as compared to its other policy tools.

As Evan Soltas (Bloomberg) demonstrates, whether or not the Bernanke actually pulls the lever, the tightening has already gotten underway…

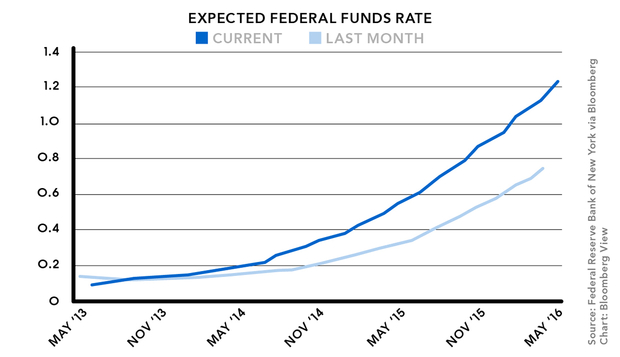

Monetary conditions are certainly tightening. The accompanying graph depicts the market’s expectation of the federal funds rate, the baseline short-term interest rate the Fed targets, from now to 2016. It shows that expected rates have risen sharply over the last month. (Expected rates hadn’t moved much before that this year.)

The market had thought last month that, in April 2016, the Fed would have the rate at 0.75 percent. It now thinks it will be 1.15 percent at that time. Since the target rate is set in increments of 0.25, that implies a 60 percent chance of 1.25 percent and a 40 percent chance of 1 percent. Similar hikes have occurred across the board.

That’s a serious tightening in a very short time: Expected rates have risen on average 40 percent. The timeline of rate hikes has leapt forward 8 months. Economists generally think that monetary policy’s most powerful channel is through expectations, so the Fed’s shift could have a big impact.

Josh here – When is an expected rate hike exactly like a rate hike? When people begin changing their behavior and the way they’ll lend and invest based on how they see the future.

We got a taste of that already and the markets haven’t yet completely gotten accustomed to how it feels.

Source:

The Fed Is Tightening, Whether or Not It Wants To (Bloomberg)

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/06/15/the-de-facto-tightening/ […]