This morning we got news that Morgan Stanley’s chief strategist has flipped bullish after fighting the rally the whole way. The hardest part of forecasting – the thing that strategists just never seem to get, is that you can’t predict mass-sentiment. And sentiment is what determines what multiple investors – en masse – will be willing to put on a dollar of earnings.

Hear’s my friend The Wall Street Ranter with a guest post on the degree to which PE multiple expansion has aided the current four-year bull and a comparison to other bull markets in the past. Enjoy! – JB

***

Is This Bull Market Fundamentally Driven? (A Look at PE Expansion)

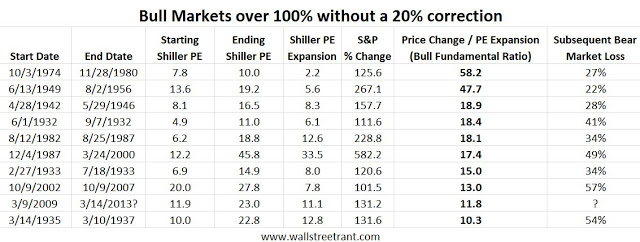

This post over at The Big Picture Blog which had a listing of Bull markets of 20% or more without a 20% correction got me thinking about Bull Market fundamentals. Some people talk about this bull market being driven by the Fed and not fundamentals (me included). I can easily point at a Shiller PE of 23 to highlight overvaluation but I wanted to look at it another way, so I focused on PE expansion.

Fundamentally driven bull markets should rely more on cyclically adjusted earnings growth and less on investors willingness to pay ever increasing multiples on those earnings. To look into this I decided to focus only on bull markets of 100% or more. I looked at the Starting and Ending Shiller PE using Robert Shiller’s online data and updated it with daily pricing data for the important dates (as he only has monthly prices). Then I divided the Bull Market gains by the amount of PE expansion to see how much gains investors were receiving per unit of PE expansion. The results are below, sorted by most fundamentally driven to least fundamentally driven. The results are quite interesting.

Take a look at the 1974-1980 Bull Market compared to today….The magnitude of the advance is similar between the two but the 1974-1980 advance only relied on a PE expansion of 2.2 vs 11.1 today. You will also notice that those that relied least on PE expansion tended to experience smaller subsequent bear markets. The top 5 averaged a bear market loss of 30.4% vs the bottom 4 which averaged a 48.5% loss. If history is any guide people should expect that the next bear market will be deeper then average because this bull market is lacking a fundamental underpinning.

Source:

Follow @WallStreet_Rant on Twitter

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]

… [Trackback]

[…] There you can find 94984 additional Information to that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/03/19/one-of-the-most-sentiment-driven-rallies-ever/ […]