One of the more exciting new guys to begin contributing to StockTwits / Twitter of late is Ari Wald, chief of technical strategy at PrinceRidge.

The below comes from his latest note – JB

***

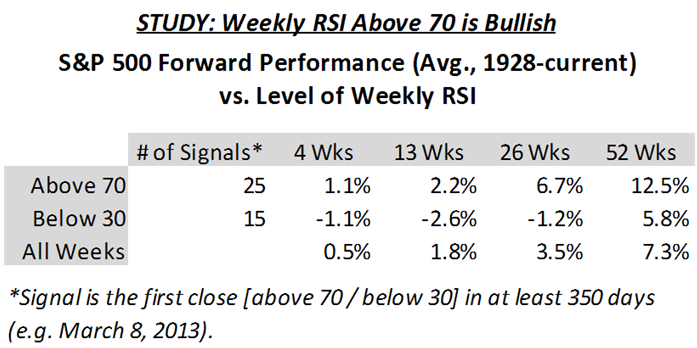

STUDY: Strong Trends Tend to Continue

In our view, recent rally highs in the S&P 500 can be considered “good highs.” In other words, stocks have run a lot in a short amount of time, but confirmed conditions indicate “buy-the-dip” strength. The S&P 500’s weekly RSI, for instance, has reached a “bullish overbought” reading above 70 for the first time since January 2011. Contrary to what one might expect, this is a bullish signal for the S&P 500.

In fact since 1928, the S&P 500 has averaged a 6.7% gain over the next 26 weeks when weekly RSI makes a fresh close above 70 (“bullish overbought”). This compares to -1.2% when weekly RSI closes below 30 (“bearish oversold”) and a 3.5% gain during any 26-week period (table and signal definitions below). This implies that strong trends (i.e. those that are confirmed) tend to continue, and supports our view that a cycle top has not been reached.

You can click to embiggen the below chart / table:

***

Thanks Ari!

Source:

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] There you will find 76477 more Info to that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] Here you will find 46310 more Info on that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] There you can find 46539 additional Information to that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/03/14/ari-wald-good-highs-and-bad-highs/ […]