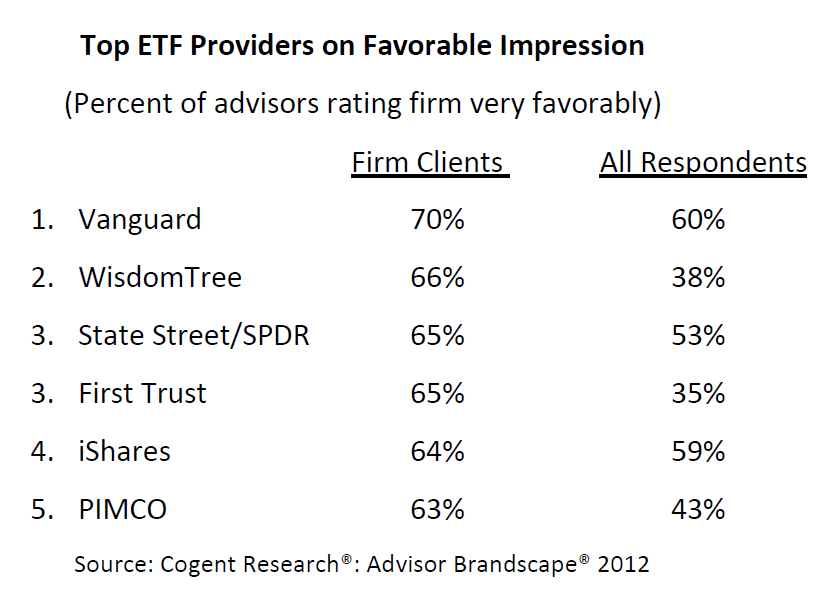

Cogent did a survey of its clients (adviser firms and brokerages) and other industry pros to determine which ETF provider has the most “favorable impression” in the eyes of the wealth management industry. And Vanguard is crushing the field. This is ironic when you consider the fact that vanguard was initially opposed to ETFs (in the waning days of Jack Bogle) and so was a relatively late entrant. But having the lowest fees makes up for that as does the notion that with Vanguard, what you see is what you get. Advisers like myself who are looking to contain costs and utilize plain vanilla indices love Vanguard and the survey confirms this.

Now you may ask, why does favorable impression matter and not AUM or tracking error, etc…My answer is that impressions are almost everything all else being equal, and many of the large ETF providers are offering overlapping products.

(for the record, our model portfolios utilize every family on this list)

From Cogent:

In addition to leading the market in favorable impression, Vanguard achieves top ratings in association with several brand imagery attributes which serve to solidify a firm’s position in the marketplace. Specifically, Vanguard achieves top marks across advisors in all channels in association with “financial stability,” “good value for the money,” “demonstrates integrity and honesty,” “fee transparency,” and “a brand clients know and trust.” Meanwhile, iShares still owns the key categories of “leader in the ETF industry” and “offers products with consistent liquidity,” although the gap with rivals is decreasing as other providers have seen improving perceptions in these areas.

… [Trackback]

[…] Here you will find 36870 additional Info to that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Read More Info here on that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Here you can find 82286 more Info on that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]

… [Trackback]

[…] Here you will find 1939 additional Info to that Topic: thereformedbroker.com/2012/07/24/etfs-everyone-loves-vanguard/ […]