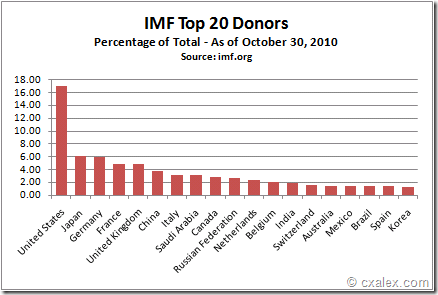

Updated: I’ve added the above chart to give you some idea of non-Euro Zone IMF funding countries as of 2010.

Of course we are.

Our story so far: Euro Zone ministers have announced four separate “comprehensive plans” to stop the crisis over the last 19 months, each of them failing faster than the one before. And now, the solution they’re expecting will be coming from the IMF, at long last. But we knew that this would be the case, deep down. Of course the world capital of bailouts was going to ultimately be involved.

When you hear that it will be the IMF, don’t be fooled, 20% of the IMF’s funding comes from the US and Britain. The IMF will need real money from the Federal Reserve to actually do anything effectively in the EU, they simply don’t have the ready cash on their own.

In fact, Geithner is flying out this week to meet with the Euro finance people, obviously crafting the mechanics of an IMF-led solution will involve the ultimate financier of it all – us..

So if you didn’t see this coming, here’s your spoiler alert: The US and Friends are the White Knights, it’s only a matter of time and how they phrase it.

Here’s Bloomberg today:

Dec. 2 (Bloomberg) — A European proposal to channel central bank loans through the International Monetary Fund may deliver as much as 200 billion euros ($270 billion) to fight the debt crisis, two people familiar with the negotiations said.

At a Nov. 29 meeting attended by European Central Bank President Mario Draghi, euro-area finance ministers gave the go- ahead for work on the plan, said the people, who declined to be named because the talks are at an early stage. The need for a new crisis-containment tool emerged as the effort to boost the 440 billion-euro rescue fund to 1 trillion euros fell short.

Under the proposal, national central banks would recycle funds through the IMF, potentially to underwrite precautionary lending programs for Italy or Spain, the two countries judged to be the most vulnerable now, the people said.

“We’re looking for a maximum reinforcement with the IMF and the central bank,” Belgian Finance Minister Didier Reynders told reporters Nov. 30.

And here’s the New York Times:

WASHINGTON — European leaders are looking outside the continent for help solving the longstanding crisis over the euro, but while the International Monetary Fund may be able to help, it will not be the magic wand they seek.

The fund may be asked to assist further as leaders of the 17 European Union nations that use the euro meet to prepare for a summit meeting on Thursday and Friday. Chancellor Angela Merkel of Germany and President Nicolas Sarkozy of France are scheduled to hold talks in Paris on Monday, and, at the request of President Obama, Treasury Secretary Timothy F. Geithner is meeting with European leaders next week.

Don’t fall out of your chair, this was inevitable all along.

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Here you can find 63611 additional Info to that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] There you will find 9658 additional Information to that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] There you will find 71968 additional Info on that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Here you can find 81057 additional Info on that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2011/12/03/spoiler-alert-were-about-to-bailout-europe/ […]

buy cialis ebay

American health

order original cialis online

Generic for sale