Real quick here, this is a rant but a thunderous one…

I’m seeing all kinds of bottoms being formed on an anecdotal basis. I usually do data-driven (or at least supported) things here, but today we get a little bit squishy. We’ve reached peak-nonsense in a few places and I just have to shout them out as I see ’em. Take this all with a grain of salt if you need to, but you better recognize.

A Bottom in the Japanese Birth Rate:

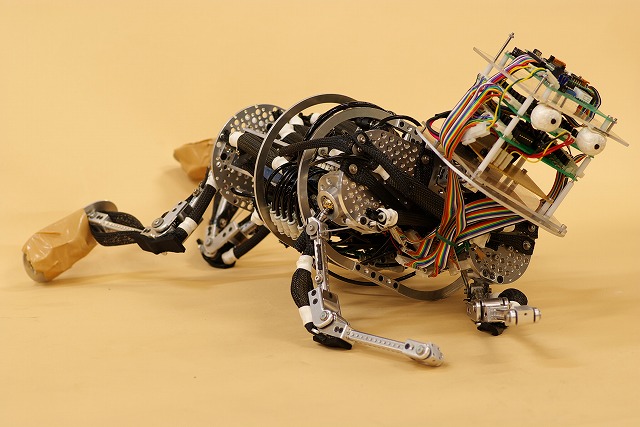

Fund manager Kyle Bass has postulated that Japanese people will be buying more adult diapers than baby diapers soon as his reason to short the country’s equities. This is a hilarious quip but is not necessarily an investible premise. There are very smart people who are now looking to short the “Miraculous China Demographics” theme and go long Japan as a relative value – see Barron’s recent “Favoring Japan Over China“. And as for that birthrate – again, speaking anecdotally – Japanese technology companies are seeing such consternation over the demographic problem that they are now designing robot infants (called Pneuborns), what does that tell you?

Many very smart investors are growing more and more excited about how universally hated Japan is as an investment theme. I recommend Geoff Gannon and Barton Biggs for a starting point on the bull case if you’re sick of the knee-jerk negativity.

A Bottom in Housing and Homeownership:

Stop looking at building activity and home building starts for your gauge of house prices. The truth is they have bumped along the bottom and they are starting to turn higher, here’s Citigroup’s Josh Levin: “More timely data indicates that home prices are actually going up on a m/m basis and have been doing so since February”.

The pace is excruciatingly slow and frustrating and all markets are local, but the direction is clear to anyone without an axe to grind.

Also, the amount of hatred for homeownership has officially peaked as well. No, there’s nothing wrong with renting but owning a home will always be the best thing Americans can do for their families in the aggregate. I love James Altucher and he makes compelling points in posts like these, but for 99% of people who are not buying during a debt-driven mania, the home purchased with a reasonable mortgage in a nice neighborhood becomes the one asset they are most proud of and satisfied with when all is said and done. Not one of my parents’ friends or my uncles and aunts have ever said “I wish I hadn’t bought that house” now that their kids are grown and having grandchildren.

I rented an apartment in Manhattan for years, I have nothing to show for the tens of thousands of dollars I gave away to the landlord except for my memories. Good luck monetizing those.

Also, there are no toxic houses, only toxic mortgages or prices. My kids have a home base that I’ve built for them. No, it’s not an “illusion” as the misanthropes will tell you, it is an actual physical place where they know they are from and can always come back to no matter what. My neighbors care about the appearance of their homes and take care of their stuff because we are owners. Sure we pay high taxes, but we have clean parks, good schools and a responsive police force because we pay those taxes, for better or worse.

The idea of Homeownership was way too obsessed over in 2005, it is way to reviled today in 2011 – the truth is somewhere in between and for most people it is not just another investment, it is a way of life.

A Bottom in Respect for the Presidency:

This all started with Bill Clinton. I liked him and I personally don’t care who gets oral sex from whom, but the fact that he did so in the Oval Office seems to have flipped a switch in the consciousness of the American public. We began looking at the President as massively fallible and his office as not such a big deal after all. It has gotten steadily worse. The brain donor we elected and then re-elected last decade didn’t help matters and the disrespect over Obama’s birth certificate was basically the absolute bottom. However, there’s some good news.

The celebritards like Donald Trump and Mike Huckabee are bowing out of the race. Why? Maybe Bin Laden’s death at the hands of the White House has intimidated them, maybe they now see that they are unelectable again as people begin to regain respect for the White House and the office of the President. It’s early, but it is very possible that we’re not going to look at our President as a reality show character anymore and that respect is coming back. Trump’s people have done their clandestine polling and have probably reported back to him that the people won’t commit that final act of contempt by giving him the nomination, let alone a real shot at the Presidency.

***

That was a bit of a venting session, but how many times can you watch a dead horse get beaten without finally intervening?

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/05/16/three-things-that-are-bottoming/ […]