You can spend a whole career on Wall Street but you haven’t met a real trader until you’ve met one these Chicago guys.

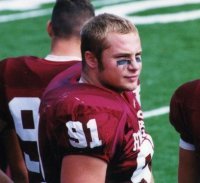

Eli Radke, up-and-coming trader and blogger, is a 320-pound former Indiana University defensive lineman with an awesome story about how he earned his first trading stake. He did it the old-fashioned way – jumping off the LaSalle Street Bridge into the Chicago River.

The desire to trade and the allure of being a part of the trading culture knows no bounds sometimes. I’ve asked Eli to tell us his story. There is a lesson in here about entrances and exits that will ring true to any trader with capital on the line. Here’s my pal Eli in his own words…enjoy!

***

After college, I still had pipe dreams about playing professional football. Come

August it was obvious that was not going to happen. I never applied for a job

and quite honestly I knew I did not want to work for anyone. I worked for a few

months for my father, who has an industrial construction business. I choose to

have a father instead of a boss. I had met a guy earlier in the summer who was

a trader and also had some restaurants. I met him for lunch one day a Rivers, a

restaurant in the building where the CME floors were at the time. He showed me

the floor and I was hooked. He let me hang out in the office for a bit and I

worked in a restaurant at night.

One day we were walking across the Monroe Street bridge on our way to

breakfast. I made some comment about the bridge not being very high. He said I

will give you give you 5k to jump off. I hesitated for a bit, then started to take my

phone and wallet out of my pockets. He balked and so did I.

A few months later, we were having a few drinks. Let me preface that by

saying that I probably have a different definition of “a few drinks”. That particular night

we were doing shots of Rumple Minze or as I now refer to it, River Minze. We are

crossing the LaSalle street bridge to go to another place. At the beginning of

the bridge I reminded him about the time he bet me to jump off. By the time we

had crossed the bridge I had handed him the contents of my pockets.

After some final negotiations I climbed over the rail and jumped. As I am

falling I hear his best friend, who happens to be a money manager, say “Make sure

you have a way out.” My family is from Minnesota so I learned swimming the hard

way – survival. I swam over to a column. As I looked around I saw

an ambulance, the Chicago Fire squad and the Chicago Scuba squad on Wacker Drive.

I thought, “I hope they bail me out.” The column was about 20 or so feet away

from the wall. I can’t remember the exact month but it wasn’t summer. I swam

to the edge of the bank. I tried to step up on the 2 x 6s but they kept breaking.

I was about carrying around 320lbs and was fully clothed. I started to panic a bit

after breaking several boards. I finally find a ladder. I pull myself out of the water.

The wall has chicken wire and I use it to climb onto Fulton Market’s patio. There are two

ladies screaming at the group of guys who were still on the bridge.

I was once again worried about being arrested. The police and rescue

were not there for me, thankfully they were using the resources for someone who was not

an idiot. I did not know that at the time. LaSalle is one-way going south so

they would have had to go around the block. We walk to the next street and a

group of about 10 guys are shielding me from the cops. I try to get a cab and

of course they do not want to pick up a dripping wet passenger. Still not

knowing if the coast is clear we walk into another bar. I go to the bathroom.

I am freezing and my adrenaline is pumping. I look in the mirror and proceed to

projectile vomit. I clean up a little and walk out. Of course they have another

shot waiting for me.

I take the shot and get a cab home. When I get home I run a hot bath. I had

forgotten to drain the bathtub and the next morning it was black. The next day,

I go to work. He gave me $500 cash and put the rest in an account.

I learned a lot about trading in that moment. Traders (my friend) and money

managers (his friend) think very differently. Traders value the entry and

managers value the exit. I also learned that if you need to make money, you

often risk too much. Luckily it all worked out. It could have gone a different

way. The bridge is much higher than I thought and the water was much colder.

Apparently there was a rumor that I had died. I have met a few people that tell the

story and I just sit back and listen. It is interesting to hear the

variations. The money was a good start but the lesson was invaluable. I would

not change the experience but it was not the smartest thing I have ever done.

***

Eli, you’re an animal. Thanks for that story!

For more of Eli’s trading commentary visit his blog at http://traderhabits.com/about/

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2010/12/02/the-legend-of-eli-radke/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2010/12/02/the-legend-of-eli-radke/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/12/02/the-legend-of-eli-radke/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2010/12/02/the-legend-of-eli-radke/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2010/12/02/the-legend-of-eli-radke/ […]