“Avoiding risk may feel sensible to a generation whose financial coming-of-age has been bookended by the dotcom bubble and the subprime-mortgage meltdown.”

When you talk to a Gen-Yer or a Millennial about stocks, you sense a vague connection between the subject at hand and a ride on Disney’s Splash Mountain beginning to form in an almost-tangible, cartoon thought bubble above their head.

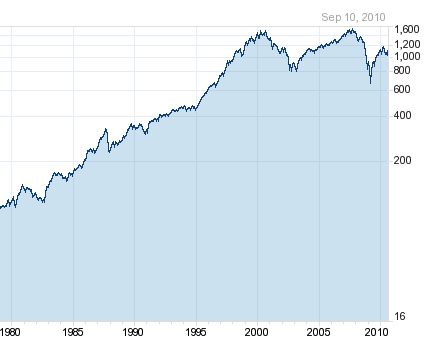

18 to 34 year olds (I’m one of them) have seen virtually nothing but Death and Dismemberment from the stock market overall, despite the new NASDAQ highs of 10 years ago and Dow 14,000 top of ’07.

Our psyches are collectively scarred by the devastating crashes that stocks are capable of. The index highs of our generation’s recent memory barely seem to register at all compared with the ‘Nam Flashbacks of job losses and bankruptcy that stock sell-offs have meant to young adults so far.

Our connection to the stock market is as follows:

“Stocks go up, Mom and Dad buy a lot of stuff.”

“Stocks get killed, college tuition has now disappeared, our house is on the market and there won’t be any job for me anyway.”

In my discussions with people of my own age group and slightly younger, this feeling is fairly prevalent. There’s a kind of irony in the fact that the young are now more cautious than their Baby Boomer parents when it comes to investments.

Stock market volatility has meant hard times in real life for young adults, not just lighter brokerage statements. It has meant shock layoffs, career changes, and the dismantling of whole industries like mortgage, banking, real estate, media and advertising.

Several studies quantify this phenomenon (as collected by Newsweek):

In 2010, only 41 percent of 18- to 29-year-olds reported working full time, compared with 50 percent in 2006, according to the Pew Research Center. Millennials were more likely to report losing their jobs than workers over the age of 30, and many recent college graduates have had a hard time finding a toehold in a tight labor market, even as the national unemployment rate rose Friday to 9.6 percent. If the 18- to 34-year-olds feel more cautious about investing, it’s partly because they have less money to spend and little economic security.

The upshot here is that my generation was a bit too young to have really benefitted from the 1982 to 2000 bull market, one of the best and most prosperous of all time. Our parents made most of their money in those years and became comfortable with stocks in a way that young people now probably never will.

As you can see from the chart above, the S&P 500 was a lot more fun from 1982 to 2000, after that, much less so.

That being said, if we are truly more than halfway through the bear cycle that many expect to be over in the late Twentyteens, then who is to say that the timing won’t be perfect for the Millennials after all? Should a new bull cycle coincide with their peak earning years, “comfort with stocks” may coalesce very, very quickly, just like it did for Mom and Dad.

Sources:

[…] wrote about my generation the other day in terms of its hesitancy to own stocks in my post We’re The Kids in America . Thomson gives us a look at another side of the same coin with a rundown of the Millennial […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] There you will find 32176 additional Info to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] There you will find 20916 more Information to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] There you will find 75798 more Info to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] There you will find 1385 additional Info on that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2010/09/11/were-the-kids-in-america/ […]