I’m not writing this post as a “Short China” thing, but man does this scare me away from building commodities and the related stock names levered to them…

I’ve relayed a lot of these stats here already, but this morning I found a really excellent roundup of Chinese real estate bubble signs.

From the Toronto Star:

Frenzied developers with access to cheap money are creating a glut of premium office space and luxury apartments, priced at about 80 times the average income of the city’s residents. Prospective middle-class homeowners, in panic-buying mode, are snapping up two properties at once, hoping to flip the second one to finance the first. Civic officials are encouraging the building boom.

The sale of vacant lots bolster their municipal coffers.

Banks eager to reap upfront fees are granting mortgages to all comers. Even factory owners are in on the speculation, generating more profit from flipping property than from traditional manufacturing, which increasingly is moving offshore to Vietnam, Malaysia and other nations with lower labour costs.

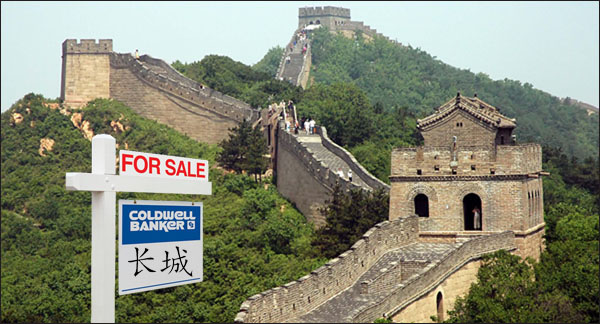

No, this isn’t Toronto in the late 1980s, or Santa Barbara or Tallahassee six years ago at the height of America’s record housing boom, which culminated in a global credit crisis and ensuing recession.

This is Beijing today…

The rest of the article by David Olive does a great job of gathering anecdotal and empirical stuff. As more people wake up to the lunacy of China’s commercial build-out, Chanos will have company on his side of the trade.

Source:

China’s Building Bubble About to Burst (The Star)

Read Also:

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2010/02/21/welcome-to-beijing-a-real-estate-free-for-all-like-no-other/ […]